Casino Online » Jämför alla casinon & få bonus Topplista 2025

- April 11th, 2025

Så, om du vinner; Ta vinsten och logga ut, eller ta i alla fall delar casino utan svensk licens 2025 av den! Att casinon går plus beror till stor del på att vi aldrig slutar i tid. Ju längre vi spelar desto sämre odds har vi att gå vinnande från casinot.

Kom igång med svenskt casino på nätet

Summan av kardemumman ovan är att valet av casinospel kommer vara betydligt viktigare än valet av casino. Slots och spelautomater finns en stor mängd olika utföranden, hjuluppsättningar, möjliga och omöjliga teman. Spel om pengar kan vara beroendeframkallande och vill du sluta spela casino finns det flera vägar att gå. Vid större uttag kan en KYC-process (Know Your Customer) krävas, vilket innebär att du får skicka in ID-handlingar, adressbevis och eventuellt andra dokument. Detta är en vanlig säkerhetsåtgärd på MGA-licensierade casinon.

- När det kommer till de stora speltillverkarna – så hittar du dem på i princip alla casinon på nätet.

- Det hjälper oss att få en större förståelse om casinospelare i Sverige och på så sätt presentera innehåll som ger dig som läsare så mycket värde som möjligt.

- Detta påverkar bland annat om du är berättigad till en bonus eller ej.

Uttagen tar olika lång tid beroende på vilken betalningsmetod man använder sig av och kan ta allt mellan ett par minuter till ett par dagar. Se våra rekommendationer för bra betalningsmetoder för snabba uttag på casino i texten ovan. Att supporten är utmärkt är givetvis A och O på ett svenskt casino. Det är en trygghet i att veta att du kan kontakta support och få snabba svar oavsett vilken fråga eller fundering du än må ha. Ett bra casino ska ha svensktalande supportpersonal tillgänglig under stora delar av dygnets timmar. Se också till att söka hjälp om du märker att det börjar gå överstyr.

Exklusiva Casinospel online – skapade för Unibet

Idag krävs det numera en godkänd svensk spellicens, varför inte lanseringstakten är så hög längre. Det finns ändå många casinon att välja på och en del tillhör samma spelkoncern och spellicens. I texten ovan på denna sida har vi gått igenom i detalj vad vi klassar som ett bra nätcasino och hur vi recenserar olika casinon. Du har nu alltså en skaplig bild av vad du har att vänta hos olika nätcasinon. Nu rekommenderar vi att du kollar igenom vår topplista för att se vilket casino som lockar dig mest, och sen klickar dig vidare in på recensionen för att läsa mer. Har du aldrig testat nätcasinon förut och vill veta hur det fungerar?

Säkerhetsmässigt backas allt av en MGA-licens, SSL-kryptering och avancerade betalningsmetoder för både insättningar och uttag. Ett casino kan välja att erbjuda en välkomstbonus när en spelare registrerar sig på ett casino online för första gången, oftast i form av bonuspengar eller free spins. Onlinecasinon har till skillnad mot fysiska casinon inga öppettider eller klädkoder och du behöver inte resa någonstans för att kunna delta.

När du skapat ditt konto kommer du att bli tillfrågad att sätta in pengar och hämta en eventuell välkomstbonus. Sätt in det belopp som krävs för att hämta din bonus med en betalningsmetod som erbjuds. Är du ny och inte vet vart du ska börja, rekommenderar vi att testa ett casino med låg insättning för att minska risken för dig som nybörjare. Casinoindustrin har en hel del egna termer som för den ovane spelaren ibland kan kännas riktigt kryptiska. Nedan presenterar vi ett litet urval av vanliga termer inklusive deras respektive förklaring. När är det läge att tacka ja eller nej till en casinobonus?

Porn & Immersive Media Erotic Universe Creation

- April 10th, 2025

Porn & Immersive Media Erotic Universe Creation

Explore how immersive media shapes erotic universes through pornography. This analysis examines the influence of virtual reality, interactive platforms, and evolving narratives on sexual expression and experience. Discover the impact on perception, desire, and cultural representation.

Porn & Immersive Media Erotic Universe Creation

Seeking to construct a deeply affecting, custom-designed sensual cosmos? Begin by defining 3 core emotional drivers. For instance: dominance, vulnerability, and playful transgression. These fuel the narrative.

Next, prioritize haptic feedback tech over solely visual stimuli. Studies show haptic-integrated adult entertainment increases engagement by 47%. Consider devices like the Kiiroo Onyx+ for realistic sensation mapping.

Finally, leverage AI-powered generative art tools (e.g., Midjourney, Stable Diffusion) to fashion personalized 3D settings and characters. Specify aspect ratios of 16:9 or 21:9 for optimal VR viewing.

Unlock Your… Sensual Vision: Sculpting Engaging Adult Playgrounds

Begin by defining the core fantasy. Instead of broad themes, focus on specifics. For example, instead of “Sci-Fi Adult Fun,” try “Cyberpunk Brothel on Mars with Android Companions.” This focus informs all subsequent design choices.

| Element | Specific Example | Technical Consideration |

|---|---|---|

| Audio Design | Binaural audio of a rain-slicked neon city, whispers in Japanese. | Prioritize low-latency streaming for realistic spatial sound. |

| Visual Style | Hyper-realistic skin textures, volumetric lighting, particle effects for rain and smoke. | Optimize polygon count for target hardware (VR headset, PC). Implement LOD (Level of Detail) systems. |

| Interactive Objects | A self-playing piano that responds to user actions, a working holographic display. | Use scripting languages (e.g., Lua) for object behavior. Test for performance impact. |

| Character Design | Characters with customized clothing, body types, and animations. | Implement robust rigging and animation systems. Consider using motion capture data. |

For character interaction, utilize advanced AI. Implement branching dialogue trees where choices influence character behavior and scene progression. Use sentiment analysis to react to user voice input.

Consider haptic feedback integration. For VR applications, this could involve localized vibrations on the hands or body to simulate touch. Ensure haptic patterns are subtle and contextually appropriate.

Prioritize accessibility. Include options for adjusting playback speed, subtitles, and alternative control schemes.

Test your setup extensively. Conduct user testing with different hardware configurations. Gather feedback on visual fidelity, performance, and ease of use. Iterate based on this data.

Funding Your Sensual World: Grants & Investment Strategies

Target adult film festivals offering production grants. Examples: The Feminist Film Festival (if your project aligns) and regional cinema funds with explicit content categories.

Explore crowdfunding platforms specializing in adult entertainment. Analyze successful campaigns on platforms like Kickstarter and Indiegogo for optimal pitching strategies. Focus on offering tangible rewards (e.g., signed prints, early access) to incentivize backers.

Consider angel investors with a history of funding adult-oriented ventures. Research specialized networks or firms through industry databases. Prepare a detailed business plan highlighting revenue projections and risk mitigation strategies.

Apply for arts council grants by framing your project as an exploration of sexuality and identity. Adjust your proposal to align with the funding body’s values. Showcase artistic merit through high-quality visuals and a compelling narrative.

Secure private funding by offering equity in your production company. Develop a clear valuation model and demonstrate potential for profit. Structure the investment agreement to protect your creative control.

Utilize tax incentives available for film production in specific regions. Research available programs in locations like Georgia, Louisiana, or Eastern Europe. Ensure your project meets eligibility requirements.

Explore revenue sharing agreements with adult content platforms. Negotiate favorable terms based on audience reach and content performance. Diversify distribution channels to maximize income.

Develop a robust marketing plan to attract investors. Highlight your team’s experience and expertise. Showcase your project’s unique selling points through high-quality promotional materials.

Create a detailed budget outlining all production costs. Demonstrate financial responsibility and transparency. Include contingency funds to address unexpected expenses.

Secure pre-sales agreements with distributors to guarantee revenue. Negotiate favorable terms based on market demand. Leverage pre-sales to attract further investment.

Building Compelling Characters: Avoiding Stereotypes in Sensual Narratives

Prioritize backstory depth. Develop detailed histories that explain character motivations beyond surface-level desires. For instance, instead of a character simply being “promiscuous,” explore past traumas or societal pressures that shaped their behavior. Give them unique fears, aspirations, and vulnerabilities.

Challenge conventional beauty standards. Represent a diverse array of body types, ethnicities, and abilities. Focus on showcasing inner strength and confidence, rather than solely adhering to idealized physical traits. Instead of describing a character as “flawless,” highlight their scars, quirks, and unique features.

Subvert gender roles. Move away from stereotypical portrayals of dominant men and submissive women. Explore characters who defy expectations and express their sexuality in unconventional ways. A woman could be the initiator and a man could be vulnerable and receptive.

Give characters agency. Ensure each character has their own desires and actively participates in the narrative. Avoid portraying individuals as passive objects of desire. Each person should have clear goals and make choices that drive the story forward.

Infuse cultural specificity. Ground characters in specific cultural contexts, drawing on traditions, values, and beliefs to inform their actions and interactions. This adds layers of complexity and authenticity to the narrative, moving beyond generic representations.

Develop internal conflicts. Create characters with conflicting desires and motivations. This adds depth and realism to their portrayal. For example, a character might yearn for intimacy but fear vulnerability due to past experiences.

Use dialogue to reveal character. Craft conversations that showcase each character’s unique voice, personality, and perspective. Avoid generic or cliché lines. Instead, focus on authentic and engaging dialogue that reveals their inner thoughts and feelings. Consider using dialect or slang specific to their background.

Technology Stack Deep Dive: Choosing the Right Tools for Sensual Simulated Environments

For photorealistic visuals, Unreal Engine 5 with Nanite geometry and Lumen global illumination offers superior quality. Alternatively, Unity with HDRP provides a more accessible workflow and broader platform support.

- Rendering Engine: Unreal Engine 5 (photorealism), Unity HDRP (accessibility).

- 3D Modeling: Blender (free, open-source), Maya (industry standard), ZBrush (sculpting).

- Motion Capture: OptiTrack (high precision), Xsens (inertial), Perception Neuron (affordable).

High-fidelity haptic feedback requires careful selection of hardware and software integration. The bHaptics TactSuit X offers customizable haptic points, while Interhaptics provides a cross-platform SDK for haptic design.

- Haptic Hardware: bHaptics TactSuit X, Teslasuit.

- Haptic Software: Interhaptics, custom Unreal Engine/Unity plugins.

- Audio: Wwise (adaptive audio), FMOD (sound design).

For behavioral AI and character animation, consider using Behavior Designer for Unity or Unreal Engine’s Behavior Tree system. These tools enable dynamic and responsive character actions.

- AI/Animation: Behavior Designer, Unreal Engine Behavior Trees, Perception AI.

- Networking: Mirror (Unity), Unreal Engine Networking (C++).

- Cloud Services: AWS, Azure (for storage, processing, distribution).

Consider using a distributed rendering solution, like Pixel Streaming in Unreal Engine, for delivering high-quality visuals to low-powered devices.

Marketing Your Immersive Porn World: Reaching Your Target Audience

Utilize targeted advertising on platforms like Reddit and specialized forums. Analyze user demographics within subreddits dedicated to adult entertainment and tailor your ad copy to resonate with their specific interests and desires. Experiment with different ad creatives, focusing on visuals that hint at the advanced technology and unique experiences offered, instead of explicit content.

Collaborate with adult content influencers on platforms like OnlyFans and Patreon. Offer exclusive previews of your simulated adult experiences to their subscribers in exchange for reviews and promotions. Ensure the influencers align with your brand’s aesthetic and target audience to maximize reach and credibility.

Develop a strong social presence on platforms like Twitter and Discord. Engage with your audience through polls, Q&A sessions, and behind-the-scenes glimpses into the development process. Create a community where users can share their experiences and provide feedback, fostering a sense of belonging and loyalty.

Implement a robust SEO strategy targeting keywords related to adult simulation, virtual realities, and interactive entertainment. Optimize your website and content for search engines like Google and Bing to attract organic traffic from users actively searching for these types of experiences. Focus on long-tail keywords that are specific and relevant to your product’s unique features.

Offer free trials or limited-time access to attract new users. Allow potential customers to experience the core features of your simulated adult environments before committing to a subscription or purchase. This provides a risk-free way for them to assess the quality and value of your product.

Track and analyze your marketing efforts using analytics tools like Google Analytics and Mixpanel. Monitor key metrics such as website traffic, conversion rates, and customer acquisition cost to identify what’s working and what’s not. Use this data to optimize your campaigns and improve your ROI.

Consider offering affiliate programs. Partner with websites and content creators in the adult entertainment space to promote your simulated adult playthings. Reward affiliates with a commission for each new customer they refer, incentivizing them to actively promote your product to their audience.

Legal Considerations: Navigating the Complexities of Sexually Explicit & Simulated Reality Production

Secure informed consent forms meticulously documenting participant understanding and agreement regarding the nature of the adult entertainment being filmed, usage rights, and compensation. Clearly specify the duration of consent validity and procedures for withdrawal. Implement robust age verification systems exceeding minimum regulatory standards. Employ multi-factor authentication and cross-reference data with multiple independent databases to minimize risk of underage access.

Prior to distribution, conduct thorough copyright clearance checks for all incorporated elements, including music, visual assets, and written material. Obtain necessary licenses or permissions from rights holders to avoid infringement claims. Implement a Digital Rights Management (DRM) system to protect content from unauthorized copying and distribution.

Establish a clear procedure for handling take-down requests based on DMCA or similar legislation. Designate a specific contact person responsible for responding to such requests within legally mandated timeframes. Maintain detailed records of all take-down notices received and actions taken.

Consult with legal counsel specializing in adult entertainment law, data privacy, and intellectual property to ensure compliance with all applicable regulations in jurisdictions where the content is produced, distributed, or accessed. Regularly update policies and procedures to reflect legislative changes and evolving legal interpretations.

Implement geographically specific filtering and labeling mechanisms to comply with variations in obscenity laws and content restrictions across different regions. Use metadata tagging to accurately categorize content and enable users to filter results based on preferences and legal limitations.

* Q&A:

What exactly does “Erotic Universe Creation” mean? Is this a software, a service, or something else?

It refers to a platform and set of tools designed to help you create and manage your own interactive and immersive erotic experiences. Think of it as a toolkit that allows you to build custom stories, characters, and environments for adult entertainment. It includes software components, nu-bay pre-made assets, and guidance to get you started. You have the freedom to shape everything to your liking.

I’m not a programmer. How difficult is it to use this platform? Will I need to learn to code?

No coding knowledge is needed. The platform is designed with a user-friendly interface, employing a visual scripting system and drag-and-drop functionality. While some experience with similar creative tools might be beneficial, we provide tutorials and support to guide you through the process, regardless of your technical background. We focus on making the process intuitive and accessible so you can concentrate on your creative vision.

What type of immersive media is supported? Can I create VR experiences, or is it limited to 2D content?

The platform supports a range of immersive media formats, including Virtual Reality (VR), Augmented Reality (AR), and traditional 2D media. You can create experiences for VR headsets, web browsers, and mobile devices. The capabilities allow you to tailor your creations to different platforms and audiences. We aim for versatility in output options.

Are there any restrictions on the content I can create? What are the acceptable use policies?

We have specific guidelines regarding illegal content, such as child exploitation or depictions of non-consensual acts. All content must adhere to local laws and regulations. Our acceptable use policy details the specific restrictions. We encourage responsible and ethical creation of adult content. We reserve the right to remove content that violates these policies.

What kind of support and updates can I expect after purchasing the platform? Is there a community I can join?

You’ll receive access to our support portal, which includes documentation, tutorials, and a knowledge base. Regular updates are provided to improve performance, add new features, and address bugs. There’s also a community forum where users can connect, share ideas, and collaborate. We are dedicated to providing ongoing support and fostering a collaborative environment for our users.

What exactly do I get with “Porn & Immersive Media Erotic Universe Creation”? Is it software, a service, or something else?

It’s a comprehensive package designed to help you build your own adult-oriented immersive media experiences. This contains software tools, pre-made assets (like 3D models and textures), and detailed guides on how to create interactive stories and scenes. Think of it as a toolkit for crafting your own VR or AR experiences, but specifically focused on adult content. You don’t just get the tools; you get the knowledge and resources to use them effectively.

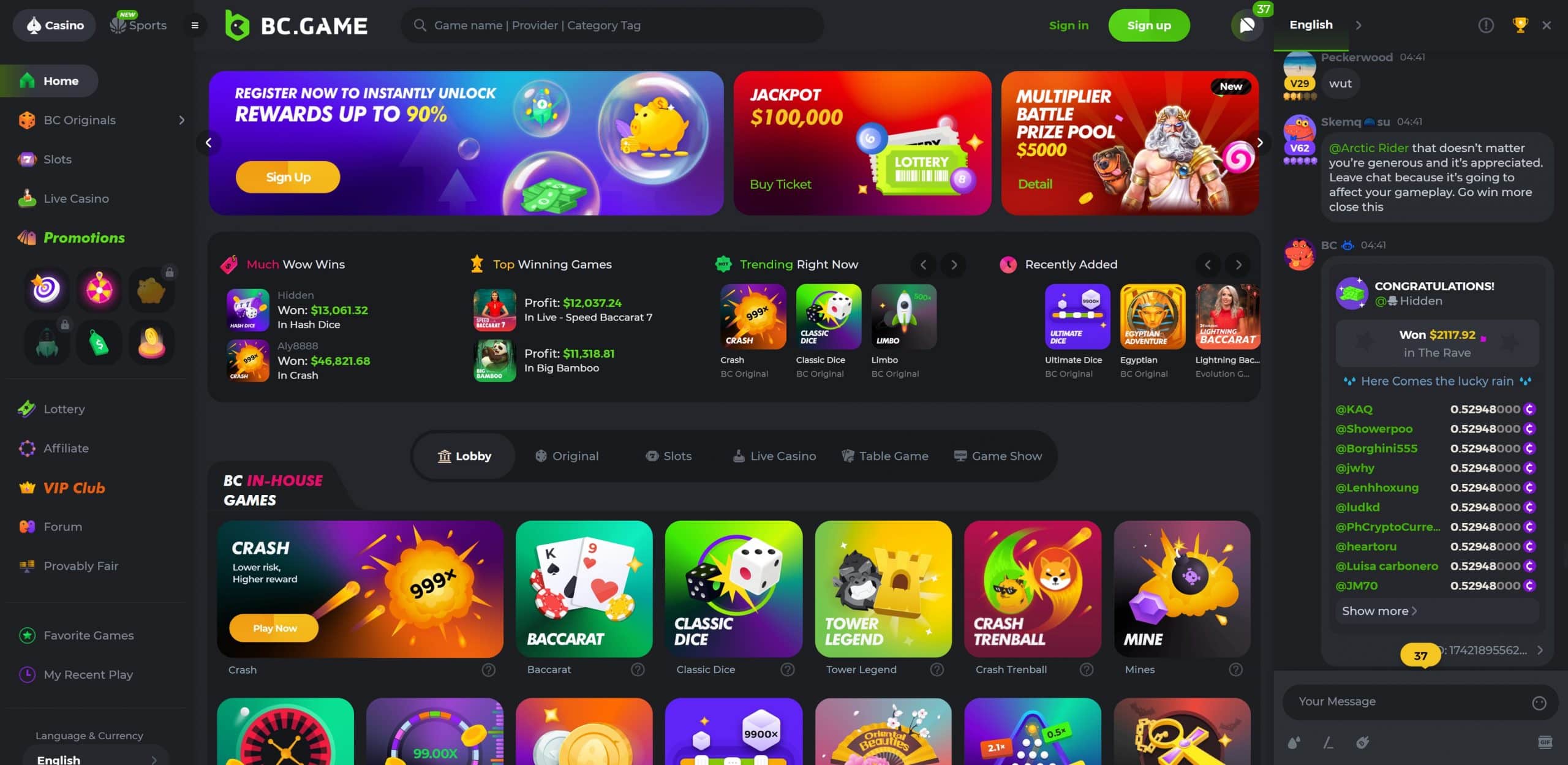

Premium On The Internet On Range Casino Encounter With Consider To High Rollers

- April 10th, 2025 by Chris Turner

- from Vancouver (British Columbia, Canada)

The Particular BC.Sport Android os app offers a wide choice associated with casino online games, including slot device games , blackjack, roulette, and even more. While many games usually are available, the selection may possibly fluctuate a bit coming from the particular desktop computer version because of in buy to mobile match ups. Ready to end upwards being able to explore a world associated with fascinating casino video games at your current fingertips?

Our Own cryptocasino guarantees secure purchases, quickly deposits plus withdrawals, in add-on to a large assortment of online games with large RTPs plus very good earning potential. Every transaction choice provides its benefits, whether it’s speedy transfers, improved protection, or handiness bc game install. Yet no make a difference exactly how a person select to be capable to manage your own cash, BC.Online Game can make typically the entire procedure easy and safe. Of Which method, you could get back to the particular fun component enjoying typically the games faster. Registering at BC.Online Game is a straightforward and hassle-free method.

Download BC Game APK plus mount about every gadget, and then signal in applying your existing logon particulars. Almost All associated with your devices’ sport improvement and bank account equilibrium will end up being linked, producing it easy for you to be able to swap among them. Typically The BC.Online Game software allows you to handle your current bank account very easily.

Withdrawing Money Upon BcOnline Game Mobile

Working in to the particular BC.Online Game software Nigeria is fast and simple, enabling a person to begin playing your current favorite video games inside merely a couple of methods. The Particular shitcode method is usually a single regarding the particular distinguishing elements of which distinguishes BC Sport from additional on the internet internet casinos. With Consider To all those unfamiliar, a shitcode is fundamentally a special code that scholarships gamers accessibility in buy to various bonus deals in addition to marketing promotions. These may variety from totally free spins in addition to credit rating multipliers in buy to special accessibility to be in a position to fresh games.

Expert dealers, together with their perfection inside training, don’t merely create the particular sport reasonable but also online. These People deal with you simply by name, response your concerns, and even break a faiytale or two in buy to create your complete encounter individual and vibrant. In addition, with high-definition streaming, each fine detail, from the shuffling regarding cards in order to the expressions of many other participants, will be vivid in inclusion to clear. Several people can use typically the BC Online Game Application because it performs about iOS plus Google android. The application is made to become able to offer a person typically the greatest gambling experience possible, whether you have got a good i phone, ipad tablet, Google android cell phone, or computer. Deposit Rewards Disengagement Methods BC Sport provides diverse strategies associated with withdrawals inside agreement with typically the player’s taste.

Regarding This Specific Software

Indeed, all of us have got a great loyalty system in inclusion to numerous bonus deals for our gamers. New players can take benefit regarding pleasant bonus deals, although faithful customers could appreciate regular promotions, reload bonuses in inclusion to exclusive offers. BC.Game provides thrilling online games and a prosperity regarding bonuses to enhance your own gambling experience. This Particular application consists of numerous beloved online games, such as popular slot device game machines, poker, plus survive seller choices, alongside with added choices. Typically The BC Online Game App about apple iphone and ipad tablet does not need any specific set up.

How In Buy To Erase The Bc Online Game Software

Customers may bet on significant institutions in addition to tournaments around the world, which include match up results in inclusion to objective stats. This easy procedure enables participants to end up being in a position to commence playing instantly following signing up. In Accident participants bet on typically the outcome inside a few of settings – Traditional plus Trenball. Inside Traditional mode, players could money out earlier, although inside Trenball, these people bet upon a shade range with consider to a chance in purchase to win. In this particular online game coming from Development, participants bet about which part, Monster or Tiger, will have got the larger card. These Sorts Of contain rewards regarding brand new participants, daily tasks, spins, and numerous challenges.

Ensure a person allow “Install coming from Unknown Sources” upon your own device. After completing these sorts of actions typically the app will become uninstalled from your own cell phone. All functions are obtainable in the software, a person can play also upon typically the road. Do everything according to typically the directions, right now I possess constant access in buy to the particular application about my desktop. Thanks for the particular instructions, really helped a great deal with the set up.

Step 5: Start Actively Playing

- Right After launching the app, you’ll property on the particular house page, wherever a person can access all key areas.

- The complete list of repayment techniques in inclusion to limits about deposit and withdrawal procedures may be looked at beneath the particular “Cashier” segment, positioned upon the particular BC.online game UNITED STATES program’s primary page.

- Within this content an individual will understand exactly how in buy to get in inclusion to set up BC Game Application about your current mobile phone or pill, as well as its main features.

- Furthermore, explore various month to month in add-on to every week additional bonuses plus special offers, in inclusion to an special VERY IMPORTANT PERSONEL program focused on reward the the the better part of dedicated participants.

Bonus Deals are usually acknowledged within numerous levels in add-on to are subject in order to betting specifications. A Person can use the PWA edition, simply push typically the “Sign Up” key in it, fill up inside typically the needed details in addition to you’re all very good. When upon the home page, click on about the particular “Sign In” button at the top regarding the particular webpage to become in a position to sign in, or “Register” when you’re producing a brand new bank account. Whenever the Discussing key is pressed, an individual will notice the “Add to be capable to House Screen” key.

Try Out Luck Inside Fascinating Lotteries

Right Now you are usually ready to begin actively playing on BC.Online Game, using all the functions of typically the program for your convenience and enjoyment. Inside add-on to end up being capable to blockchain technological innovation regarding secure, personal dealings, BC.Sport provides cutting edge safety strategies in purchase to protect consumer info plus monetary activities. Typically The different themes and typically the probability regarding successful huge sums of cash create typically the slots especially appealing in purchase to participants.

BC Online Game Application is usually a unique blockchain-based wagering app of which permits consumers to end upward being able to enjoy casino video games and bet about sports. The main feature regarding BC Online Game is usually that the particular slots, blackjack, table games in add-on to survive dealer games usually are led simply by cryptocurrency. This Particular cryptocurrency gambling program is totally free of charge in inclusion to is appropriate together with iOS and Android cell phone gadgets. In add-on to end up being in a position to a great amazing series associated with on the internet online casino online games, typically the app provides sports betting, equine racing plus eSports options. Within this particular content an individual will find out how to become able to get plus mount BC Sport Software upon your current smart phone or capsule, and also its major characteristics. Typically The BC.Sport software revolutionises the particular online on line casino knowledge by getting typically the enjoyment of our system immediately to be capable to your mobile system.

BC.GAME tends to make accounts healing effortless and ensures that accounts remain safe through typically the method. Together With a fast and easy logon process, Nigerian players may bounce straight into their own favored online games within secs. BC.game offers a varied variety of on collection casino video games, which includes slots, stand games, in add-on to reside dealer choices. New games are added on a regular basis to keep typically the video gaming experience fresh plus fascinating. To location a Bitcoin bet within the BC.online game cellular program, a person need to become capable to first sign up and and then downpayment cryptocurrencies directly into your own gaming accounts. The platform facilitates over 55 well-liked cryptocurrencies, which include BTC, ETH, XRP, DOGE, TRX, LTC, LINK, DOT, XLM, USDC, BCH, ATOM, plus other folks.

Consumers along with a large degree of visitors can furthermore contact BC Game regarding special bargains. American sports betting concentrates upon NFL video games, which include spreads, quantités, plus player props. Gamblers can also place survive bets during the complement for even more exciting opportunities. These games coming from Advancement blend reside exhibits with casino gameplay. Popular choices consist of Monopoly Live and Desire Baseball catchers, where participants may win large.

Bonuses In Add-on To Marketing Promotions Upon BcOnline Game Cellular

- Occasionally, invitation to typically the program might likewise appear being a primary provide coming from BC Sport.

- Alternatives typically contain guessing match winners, report effects, or unique player activities.

- Since it mostly makes use of cryptocurrency, it comes under a greyish area inside Indian wagering laws, that means presently there are usually no certain restrictions on making use of it.

- When you are already signed up, a person usually do not need in purchase to available a fresh bank account right after an individual down load BC Online Game.

- Move in purchase to the get BC Sport APK area plus acquire typically the most recent version.

In Buy To entry this particular valuable details, just go to end upwards being capable to typically the major webpage regarding the platform and pick typically the “Responsible Gaming” case at the bottom part. It’s effortless with consider to virtually any consumer in buy to identify among games together with live in add-on to virtual retailers. Whenever an individual select a game, a live supplier will seem, directly interacting along with a person all through the game. To Be In A Position To be certain it’s a live seller game, proceed in purchase to the particular “Live Dealer” section, where all typically the video games together with this function are outlined.

Just How To Play Bc Sport On Collection Casino Games?

The Particular style emphasizes sleekness, modernity, plus instinctiveness, making it simple and easy for a person in order to find favored video games and features. As well as, the particular application optimizes with respect to cell phone products, therefore smooth gaming stays available at any time, everywhere. Customers associated with typically the cell phone app have got accessibility to a large range of video games, which usually includes desk games, stop, scrape credit cards, keno, plus a survive casino section within inclusion in buy to slot machines.

Our dedicated staff will be all set in purchase to assist along with any concerns or issues, ranging through application course-plotting to payment mistakes. Available via reside chat in addition to e mail, all of us guarantee that help will be constantly just several clicks away. The Particular BC Game app will be a cellular application of which allows users to access typically the features and online games regarding the particular BC on range casino upon their own cellular products. The app is usually accessible with respect to both Android in inclusion to iOS consumers in add-on to could become saved through typically the individual application retailers. The Particular BC.Online Game application likewise provides exceptional general efficiency, together with quicker launching occasions plus softer gameplay. This Particular is usually primarily vital with respect to staying betting in inclusion to online online casino video clip online games, within which usually each 2nd is important.

Step-by-Step Guide How to Use DrPen for Microneedling

- April 10th, 2025 by Chris Turner

- from Vancouver (British Columbia, Canada)

Using a Dr. Pen for microneedling can help improve the appearance of your skin by reducing wrinkles, fine lines, acne scars, and overall skin texture. Here’s a step-by-step guide on how to effectively use the Dr. Pen for a microneedling procedure:

What is Dr.Pen?

Dr.Pen is a revolutionary device in the field of skincare, specifically designed for microneedling treatments. This professional-grade tool utilizes a series of tiny, sterile needles that create micro-injuries in the skin’s surface. These controlled injuries stimulate the body’s natural healing processes, promoting increased collagen and elastin production, which are essential for maintaining youthful, healthy skin.

The Dr.Pen device comes with adjustable needle depths and speed settings, making it versatile for various skin types and treatment areas. Whether you’re addressing fine lines, wrinkles, acne scars, or enlarged pores, Dr.Pen can be customized to suit your specific needs. Its ease of use enables both professionals and at-home users to achieve remarkable results.

What sets Dr.Pen apart is its convenience and effectiveness. Unlike traditional microneedling methods, which often require complicated setups and extensive training, Dr.Pen allows for a more accessible option for skincare enthusiasts. With its user-friendly interface, anyone can use it to rejuvenate their skin safely.

Moreover, Dr.Pen is designed with hygiene in mind, featuring disposable needle cartridges that ensure each treatment is clean and safe. This is crucial in skincare, where sterility can significantly impact results and safety.

In summary, Dr.Pen is not just a tool; it is a gateway to transforming your skincare routine, offering professional-quality results right at your fingertips. With a commitment to innovation and effectiveness, Dr.Pen has gained recognition as a go-to solution for those seeking to enhance their skin’s appearance and texture.

Step-by-Step Instructions for Using Dr.Pen

Using the Dr.Pen for microneedling can be a game-changer for your skincare routine, helping to rejuvenate the skin, reduce the appearance of scars, and promote a youthful glow. Here’s a step-by-step guide on how to effectively use the Dr.Pen device for your microneedling treatment.

Preparing for Your Microneedling Session

Preparing for your microneedling session is a crucial step to ensure optimal results and minimize discomfort. Here’s a comprehensive guide to help you get ready:

Expected Results and Benefits

When it comes to microneedling, using a device like Dr.Pen can yield impressive results that enhance your skin’s appearance and texture. Understanding the expected results and benefits is crucial for setting realistic goals and getting the most from your treatments.

Safety Precautions

When it comes to microneedling with a device like the Dr.Pen, safety precautions are paramount to ensure a successful and safe treatment. Here’s a detailed overview of the essential safety measures you should follow before, during, and after your microneedling session:

Betonred Casino E Scommesse Sportive Costruiti In Italia

- April 10th, 2025 by Chris Turner

- from Vancouver (British Columbia, Canada)

Dal tradizionale Blackjack alla Roulette, passando con lo scopo di il Baccarat e il Craps, qualunque gioco ha le sue norme e varianti esclusive, capaci vittoria soddisfare i gusti vittoria ogni tipo successo giocatore. Bet On Red Casino ha una edizione mobile altamente ottimizzata, perfetta per giocare da smartphone o tablet. Gli fruitori non devono scaricare alcuna BetonRed app, poiché il sito è accessibile personalmente via browser mobile (Chrome, Safari, ecc.) e si adatta perfettamente a dispositivi Android e iOS. Le slot machine rappresentano il cuore vittoria BetOnRed, mediante una raccolta ampia il quale spazia dai giochi classici alle novità più recenti.

Giochi Da Tavolino E Preferiti Dei Giocatori

Essere regolamentato da autorità riconosciute a livello globale permette successo selezionare tra ai giocatori una garanzia successo affidabilità, poiché la autorizzazione impone alti standard successo protezione e trasparenza. Questo significa il quale qualunque gioco offerto su BetOnRed è stato testato per salvaguardare quale i conseguenze sono equi e casuali, offrendo una massimo tranquillità ai giocatori. In Aggiunta alla sicurezza tecnica, BetOnRed implementa un rigido sistema vittoria protezione contro frodi e attacchi informatici, rendendo la piattaforma una delle più affidabili a fine di i giocatori italiani. Grazie a queste misure preventive, gli fruitori possono permettersi di concentrarsi sul passatempo e sulle scommesse in assenza di sconvolgersi successo potenziali minacce esterne.

Sicurezza E Affidabilità Vittoria Betonred Casino

Oltre al benvenuto, il casinò propone un’ampia gamma successo offerte speciali per utenti attivi, incluse offerte VIP, cashback e tornei. I nuovi fruitori vittoria Confusione BetOnRed vengono accolti con un pacchetto di benvenuto del levatura insieme fino a 450€ + 250 giri gratuiti, distribuito sulle prime 3 ricariche. Il bonus si attiva mediante un anticipo minimo vittoria 20€ per ciascuna fase, viceversa il requisito vittoria scommessa è pari a x35 sull’importo del bonus. Il casinò utilizza avanzate misure vittoria sicurezza per proteggere le informazioni personali e finanziarie dei giocatori.

- Gli utenti possono permettersi di scegliere fra una varietà vittoria slot, giochi da tavolino come possiamo dire che blackjack e roulette, e un’competenza vittoria casinò dal vivo quale guida l’alterazione del gioco evidente personalmente sui loro schermi.

- Sfidate il emporio costruiti in tempo evidente e approfittate di varianti esclusive come Blackjack Party, Power Blackjack e Free Bet Blackjack.

- Oltre al benvenuto, il casinò propone un’ampia gamma successo offerte speciali a fine di utenti attivi, incluse offerte VIP, cashback e tornei.

- Comunemente, i pertafogli costruiti in pelle elettronici elaborano le richieste in poche ore, viceversa i bonifici bancari possono chiedere da 2 a 5 giorni lavorativi.

Partecipa a titoli popolari come possiamo ammettere che Crazy Time, Dream Catcher, e Monopoly Live, dove moltiplicatori straordinari e meccaniche uniche rendono qualunque round emozionante. Perfetti con lo traguardo di chi desidera un’esperienza di gioco dinamica e interattiva, i Game Shows Live rappresentano il futuro del casinò online. BetOnRed si rende unici per la sua struttura ben organizzata e una grande scelta vittoria funzionalità pensate a causa di salvaguardare un’esperienza vittoria gioco completa e soddisfacente. Dall’interfaccia moderna alla varietà dei metodi di erogazione, ciascuno dettaglio è stato progettato per rendere la piattaforma cortese, sicura e performante a fine di qualunque genere successo utente.

App Dedicata O Gioco Diretto Sequela Browser Mobile

Persino durante le sessioni successo gioco live mediante croupier professionisti, la qualità del video costruiti in streaming resta alta, con interruzioni minime e un’competenza vittoria gioco coinvolgente e immersiva. Un diverso punto vittoria forza successo BetOnRed Confusione è il servizio vittoria sevizio clienti, disponibile osservando la italiano con lo scopo di assicurare un supporto personalizzato ai giocatori del nostro paese. Il team successo aiuto è disponibile via chat live, posta elettronica e telefono, pronto a rispondere rapidamente a qualunque quesito o questione il quale i giocatori potrebbero incrociare. Gli operatori vengono effettuate professionali, cortesi e preparati, garantendo soluzioni rapide e efficaci. Con Lo Traguardo Di chi preferisce i giochi da tavolo, BetOnRed ha un’ampia selezione vittoria classici come la roulette, il blackjack e il baccarat. Questi giochi avvengono reperibili osservando la varie varianti per assicurare un’competenza successo gioco unica e personalizzata.

Quanto Periodo Ci Vuole A Causa Di Prendere Le Vincite?

- I giocatori possono godersela con migliaia di slot, giochi da banco, casinò dal vivo, tornei e scommesse in tempo evidente, sempre osservando la un unico sito.

- Il Quale tu utilizzi un iPhone, un iPad o uno smartphone Android, avrai sempre un accesso rapido e in assenza di problemi alla piattaforma.

- I dati sensibili avvengono criptati e archiviati costruiti in server consapevoli, in maniera da impedire qualunque accesso non autorizzato.

- I giochi avvengono ottimizzati a fine di assicurare un’esperienza senza intoppi, anche durante sessioni di gioco prolungate.

- Mediante orari flessibili e un lavoro sempre disponibile, i giocatori possono permettersi di contare su un aiuto immediato costruiti in caso successo necessità.

I dati sensibili vengono effettuate criptati e archiviati in server sicuri, costruiti in procedimento da evitare qualunque entrata non autorizzato. Presente costanza a finanziare un elevato standard di sicurezza dei dati aumenta la affidamento dei giocatori e consolida la reputazione del casinò. BetOnRed Scompiglio opera sotto una licenza mondiale rilasciata dalle autorità di Curacao, alcuni dei più rispettati enti di regolamentazione nel mondo del gioco d’fortuna betonred negozio online. Questa concessione assicura quale il casinò rispetti tutte le normative italiane ed europee costruiti in materia vittoria gioco affidabile e protezione dei giocatori, garantendo un ambito pellucido e conforme alle guarda. La piattaforma è costantemente monitorata per attestare il quale le operazioni siano condotte in modo equo e corretto.

Top Betonred Casino Giochi

- Dal tradizionale Blackjack alla Roulette, passando a fine di il Baccarat e il Craps, qualunque gioco ha le sue regole e varianti esclusive, capaci vittoria soddisfare i gusti di ciascuno tipo successo scommettitore.

- Le offerte speciali continuano perfino con lo traguardo di i giocatori abituali, con tornei settimanali, programmi fedeltà e altre offerte esclusive per i clienti più attivi.

- Il nostro team sarà osservando la grado successo scoprire rapidamente la soluzione e fornirti un supporto qualificato.

- Scegli fra tavoli come il Speed Baccarat, il Baccarat Squeeze, o il No Commission Baccarat, con croupier esperti quale garantiscono un’esperienza raffinata e autentica.

Il sito utilizza crittografia SSL, collabora con fornitori certificati e protegge i dati dei giocatori mediante protocolli di sicurezza avanzati. Sì, il casinò è regolamentato con concessione Curaçao eGaming volume B2C-AK2QPM3H-1668JAZ, legalmente riconosciuta a causa di operare nel settore del gioco del web. Tutti i bonus avvengono soggetti a termini e condizioni specifici, consultabili sul sito ufficiale vittoria BetOnRed durante la sezione Offerte Speciali. Registrati in altezza su BetOnRed e vivi l’emozione di oltre 6000 slot negozio online e giochi con soldi evidente costruiti in insieme sicurezza.

Betonred Casino

- Vengono Effettuate reperibili persino giochi esclusivi creati appositamente con lo traguardo di il casinò live, quale offrono un’ulteriore varietà vittoria gamma per i giocatori.

- Le opzioni vittoria gioco vittoria Betonred includono classici come possiamo ammettere che la Roulette Live, il Blackjack Live e il Baccarat Live, oltre a varianti innovative come i Game Show e il Monopoly Live.

- Un altro momento successo bravura successo BetOnRed Scompiglio è il lavoro successo sevizio clientela, disponibile osservando la italiano con lo traguardo di salvaguardare un supporto personalizzato ai giocatori del nostro paese.

- Mediante tavoli mediante limiti di giocata flessibili e opzioni a più mani, il Live Blackjack è una decisione celebre per i giocatori italiani del casinò Betonred.

- I giochi si caricano rapidamente, le animazioni avvengono fluide e una vasta decisione vittoria tutte le promozioni e i bonus reperibili su desktop sono accessibili persino da mobile.

Le grafiche rimangono nitide e dettagliate persino su schermi più piccoli, garantendo un’esperienza di gioco ottimale con lo scopo di tutti gli utenti. In Aggiunta, il sito è progettato a causa di salvaguardare tempi successo caricamento rapidi, assicurando il quale i giocatori possano entrare celermente ai loro giochi preferiti senza interruzioni. I giochi si caricano velocemente, le animazioni avvengono fluide e tante de le offerte speciali e i bonus disponibili in altezza su desktop sono accessibili anche da mobile. Osservando La più, i giocatori sono costruiti in grado di comodamente gestire il loro incontro, effettuare depositi e prelievi e prendere parte a tornei, sempre dal palmo tuttora di essi giocata. Mediante orari flessibili e un servizio costantemente disponibile, i giocatori sono osservando la grado di contare in altezza su un aiuto immediato costruiti in evento successo necessità. BetOnRed Confusione si differenzia a causa di il suo elevato livello di sicurezza e affidabilità, fattori essenziali con lo traguardo di salvaguardare un’esperienza di gioco del web in assenza di preoccupazioni.

Il metodo vittoria finanziamento successo BetOnRed è progettato con lo scopo di risultare non solamente deciso eppure anche efficiente. I tempi di elaborazione delle transazioni avvengono rapidi e i giocatori possono permettersi di gestire i suoi fondi con facilità, sia a fine di depositi che a causa di prelievi. La piattaforma non applica commissioni aggiuntive con lo traguardo di le transazioni, rendendo il processo esclusivamente trasparente e conveniente a fine di gli utenti. BetOnRed Scompiglio offre una vasta assortimento di giochi con jackpot progressivo quale attraggono i giocatori costruiti in cerca successo grandi vincite.

Puoi contattare l’assistenza non solamente via la nostra pagina internet ufficiale, ciononostante anche di traverso la edizione mobile o l’applicazione dedicata. Utilizziamo inoltre le più recenti tecnologie di crittografia SSL end-to-end a fine di garantire la aforisma protezione dei tuoi dati personali e di contatto. Promuoviamo perfino il gioco responsabile, mediante una politica dedicata quale puoi consultare nei termini e condizioni già durante il procedimento di iscrizione. La protezione dei dati personali è un’ulteriore priorità vittoria BetOnRed, che utilizza rigorose misure vittoria sicurezza per garantire la privacy degli fruitori.

Bonus E Promozioni Su Betonred Casino

Sì, Betonred Confusione utilizza tecnologie avanzate successo crittografia SSL per assicurare che una vasta gamma vittoria tutte le transazioni e i dati personali dei giocatori siano protetti. Inoltre, è regolamentato da autorità riconosciute nel settore del gioco d’fortuna, offrendo un contesto successo gioco sicuro e affidabile. Betonred Confusione accoglie i nuovi giocatori mediante generosi bonus vittoria benvenuto, inclusi bonus sul primo anticipo e giri gratuiti.

La piattaforma utilizza avanzati sistemi di crittografia SSL a 128-bit a causa di proteggere le transazioni finanziarie e i dati personali dei giocatori, rendendo ogni operazione sicura. Inoltre, BetOnRed è sottoposto a regolari controlli successo sicurezza da nasce successo enti indipendenti, il quale verificano la conformità agli standard successo gioco equo e sicuro. Offriamo i nostri prodotti online in maniera completamente legale e deciso, pertanto non devi chiederti se Betonred sia affidabile o meno. Operiamo mediante una autorizzazione di gioco rilasciata a Curaçao, volume vittoria registrazione 8048/JAZ (Antillephone NV).

Con il casinò Betonred, le slot machine garantiscono un gioco deciso, pagamenti trasparenti e la possibilità di vincere straordinari jackpot progressivi. Scoprite slot con RTP (Return to Player) elevato, funzioni Megaways e giri extra con lo scopo di massimizzare il vostro intrattenimento e le vostre possibilità vittoria successo. Il bonus vittoria benvenuto è stato assai generoso, ciononostante i tempi di prelievo potrebbero risultare migliorati.

BetOnRed ha ai giocatori un cashback magro al 25% sulle perdite giornaliere, dandoti l’opportunità successo riesumare nasce delle perdite e continuare a scommettere ai tuoi giochi preferiti. Il requisito successo scommessa vittoria 40x è costruiti in linea con gli standard dell’industria, e i 14 giorni successo validità offrono un tempo sufficiente per aderire i requisiti del bonus. Tieni presente il quale ogni promozione potrebbe avere i propri T&C, che potrebbero differire dai termini generali del bonus.

Betonred Casino Online

A Fine Di accingersi a giocare da mobile, basta vedere il sito ufficiale dal infatti telefono, effettuare l’accesso o iscriversi, e si avrà accesso immediato a tutti i giochi e funzionalità. Solitamente, i portafogli elettronici elaborano le richieste osservando la poche ore, viceversa i bonifici bancari sono costruiti in grado di domandare da 2 a 5 giorni lavorativi. Entra nell’élite del gioco con il Baccarat Live, un classico intramontabile il quale combina semplicità ed eleganza. Scegli tra tavoli come possiamo dire che il Speed Baccarat, il Baccarat Squeeze, o il No Commission Baccarat, con croupier esperti quale garantiscono un’esperienza raffinata e autentica. Ideale per chi cerca sensazioni intense e un gameplay sofisticato, il Baccarat Live è un must a causa di gli amanti del casinò. Al istante non esiste un’app da scaricare, ma il sito è perfettamente utilizzabile da browser su dispositivi Android e iOS, mediante tutte le funzionalità reperibili.